LGBTQ+ Alliance tackles home-buying barriers facing under-served populations

August 30, 2024

A capacity crowd was on hand earlier this month for a “Lunch & Learn” program on “Indigenous Peoples and the Home Buying Process + Covenant Homeownership Program.”

The event, presented by the LGBTQ+ Alliance of Western Washington, featured speakers Monica La Crue, an affordable lending manager at Freddie Mac and Lisa Debrock, director of the homeownership division at the Washington State Housing Finance Commission (WSHFC).

The self-sustaining public agency works with a network of more than 120 participating lenders and hundreds of loan originators but does not work directly with home buyers. Its mission is to provide equitable access to capital.

Debrock explained the WSHFC aims to bridge gaps to homeownership for low- to moderate-income purchasers statewide, recognizing the #1 obstacle is having enough money for downpayments and closing costs. Its website has detailed information in multiple languages on getting started, free counseling, qualification requirements, a list of participating lenders, and income limits (currently $180,000).

Participating lenders qualify homebuyers for the mortgage of their choice. Lenders reserve funds on behalf of their buyers, then processes, approves, and funds the loans which are purchased by the Commission’s loan servicer. Borrowers must take a homebuyer education course and are subject to reviews of credit scores/debt-to-income ratios.

One of the popular offerings is the Home Advantage Program, which has pricing benefits for borrowers with incomes at or below 80% AMI.

The Commission offers a number of specialty down payment assistance programs, including covenant homeownership, for disabilities, other special needs, veterans and in Clark County, Bellingham and ARCH East King County, For downpayments, Debrock illustrated an example of a $400,000 loan that would be eligible for up to $20,000 in assistance.

Other resources include information on down payment assistance, a Homeowners Guide, a list of pre- and post-purchase housing counseling and service providers plus a section on various special programs pertaining to energy savings, farmland and land acquisition. Multifamily and manufactured housing are included in many of HFC’s programs. The program also allows repeat homebuyers.

Debrock also highlighted key components of the Covenant Homeownership Act, the bipartisan legislation that addresses the legacy of housing discrimination. It opened July 1 with funding through a new recording fee on real estate transactions. Assistance to low-income homebuyers is provided across the state to families that have been harmed by racial discrimination in housing.

As part of her presentation, Lisa Debrock invited audience members to connect via quarterly “Lunch & Learn” programs, community events and homebuyer fairs as well as through social platforms including Facebook, Instagram and TikTok, and office visits.

Since 1983, WSHFC home loan programs have assisted 110,000 homebuyers.

Also speaking at the August 8 program was Monica La Crue who talked about Freddie Mac’s approach to increasing generational wealth building for under-served populations. She shared data on current racial gaps in homeownership rates, but also showing homeowner household growth will be driven by minority households

The publicly traded, government-sponsored enterprise was created in 1970 to expand the secondary market for mortgages in the U.S. It supports homeownership and rental housing for middle-income Americans by buying loans from mortgage lenders, then selling them as mortgage-backed securities.

During her presentation, La Crue shared data on racial gaps in homeownership rates. She also discussed the five goals of Freddie Mac’s equitable housing strategies: expand access; reduce cost barriers; address challenges (e.g., foreclosure presentation); outreach, education and research; and address systemic underinvestment in minority homeownership.

In a 2023 update to its Equitable Housing Finance Plan, Freddie Mac included the use of Special Purpose Credit Programs (SPCPs) to expand homeownership for underserved communities. The entity uses a two-pronged approach: expanding purchases of loans originated through lenders’ SPCPs, and offering its own SPCP through an approved lender network in 10 metro areas.

Also in 2023, Freddie Mac launched a new mortgage product called HeritageOne, to support members of Native American Communities. (According to the US Census Bureau, homeownership rates for Native Americans in 2017 were at 50.8%.)

With HeritageOne, qualified borrowers can access conventional financing for various types of land ownership interests such as tribal trust land, allotted trust land, unrestricted or restricted fee simple land within eligible tribal areas. To qualify, at least one borrower in the household must be an enrolled member of a federally recognized Native American tribe who will occupy the property as a primary residence.

La Crue said Freddie Mac is also committed to tackling some of society’s most persistent housing challenges by supporting affordable housing and access to credit.

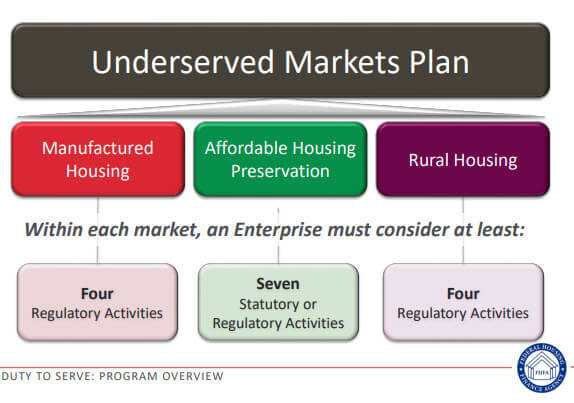

As part of its Duty to Serve plan, developed under the guidance of the Federal Housing Finance Agency (FHFA), Freddie Mac strives to make financing of manufactured housing and rural housing easier for families with very low-, low- and moderate-income, and to preserve the affordability of these homes.

Among resources La Crue noted with various low down payment solutions including:

- Home Possible®, a mortgage with a down payment requirement as little as 3% for first-time and move-up buyers and retirees. It is available to borrowers desiring a low down payment solution with flexible sources of funds.

- HomeOne® for qualified first-time homebuyers, borrowers who need flexible financing, people purchasing single family homes, including townhouses and condos, and no cash-out refinance borrowers. Down payments as low as 3% are available, and there are no borrower geographic or income limits. Eligibility criteria vary by state and program.

- HFA Advantage, a conventional mortgage available exclusively to housing finance agencies (HFAs) and approved lenders. It is intended for very low-, low- and moderate-income borrowers. Loan-level credit fees are waived for these buyers.

- CreditSmart®, a suite of free financial capability and homeownership education resources that can support consumers through every stage of their unique homeownership journey. The tools include CreditSmart Essentials, CreditSmart Coach, CreditSmart Multilingual, CreditSmart Military and CreditSmart Homebuyer U.

- Freddie Mac Borrower Help Centers and national Borrower Help Network. Both are HUD-approved counseling agencies.

Freddie Mac’s website includes an “Area Median Income and Property Eligibility Tool” that can be used to verify if a borrower falls below any required Area Median Income (AMI) threshold based on the property location and the borrower’s qualifying income.

Other tools include new and enhanced offerings, more loan purchases, market research, capacity building, homebuyer education, and outreach and engagement.

In 2022, Freddie Mac helped more than 488,000 minority borrowers purchase or refinance a home. Since 2018, as part of its Duty to Serve commitment, it has provided more than $7.6 billion to finance more than 52,000 single family homes in rural areas, primarily in high-needs regions.

About the LGBTQ+ Real Estate Alliance

Representatives from the LGBTQ+ Real Estate Alliance also spoke on the purpose and growth of this nonprofit member organization. Since its launch in June 2020, it now encompasses more than 35 active chapters spanning 13 regions across 25 states. (Washington, with two chapters, is part of Region 12, along with Idaho and Oregon.)

Representatives of the Alliance, which strives to advocate for fair housing for all and promote LGBTQ+ homeownership, noted:

- The LGBTQ homeownership rate is 49%, far below the rate of 64% for the general population.

- Laws allow discrimination against LGBTQ+ people in 31 states.

- 29% of LGBTQ+ people reported experiencing some kind of housing discrimination or harassment in a housing setting in the past year.

- State Realtor® Political Action Committees (RPACs)have donated $3.3 million over the past six years to legislators currently pushing for anti-LGBTQ+ bills.

- RPAC-funded legislators have introduced 328 anti-LGBTQ+ bills in 2024 alone. (In 2022, the Alliance sent a letter to the National Association of Realtors asking NAR to “cease funding any local, state or nationally elected officials or candidates who vote for or support anti-LGBTQ+ legislation or sentiment,” citing Article 10 of the Realtor Code of Ethics.)

- In 2024, the Alliance launched a website to track discriminatory bills and sponsoring legislators.

- Ellen Morrison, 2023 national president of the Alliance, launched a grassroots Stop Hate in Real Estate campaign. In partnership with three other major diverse organizations, a StopHateinRealEstate.org website was created, along with a Pledge focused on combatting discrimination and hate.