NAR Economist Keynotes Program on Strategies for 2024 Success

April 4, 2024

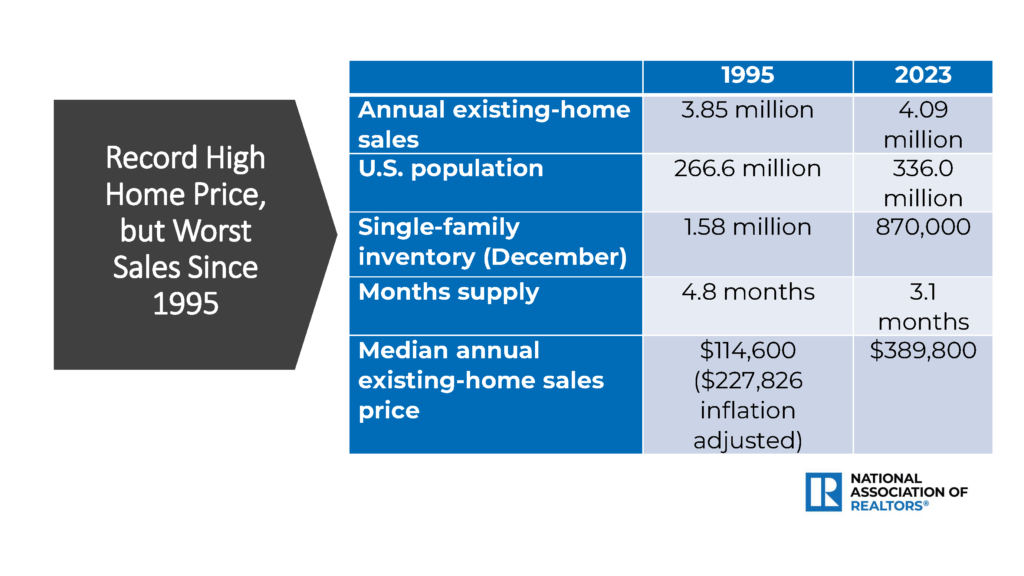

REALTORS® reported record-high home prices in 2023, based on sales of existing homes, but also the worst volume of sales since 1995, with severe shortages of inventory being a major factor for the imbalance.

Those were among insights shared by Dr. Jessica Lautz, deputy chief economist at the National Association of REALTORS®(NAR) when she spoke at a special event presented by local chapters of the Women’s Council of REALTORS® in collaboration with Seattle King County REALTORS® in February. The event, held at COMPASS Bellevue, also featured a panel of local brokerage and mortgage leaders who discussed the state of the market and business strategies for 2024.

Lautz expects inventory to improve this year, citing rising builder confidence spurred in part by some improvement in mortgage rates.

In its monthly survey of members, the National Association of Home Builders (NAHB) said February marked the largest monthly increase for builder sentiment since June 2013, excluding the period immediately after the onset of the pandemic. The group also reported the total number of single-family permits issued in January 2024 reached 75,906, surging 43.1% from the same month a year ago; 44 states posted YOY gains.

Housing starts increased 10.7% in February to a seasonally adjusted annual rate of 1.52 million units, according to data from the U.S. Department of Housing and Urban Development and the U.S. Census Bureau.

Homes listed during February received an average of 2.7 offers, up slightly from January’s figure of 2.4, according to NAR data. More than half of survey respondents (53%) reported properties sold in less than one month.

The number of buyers paying all cash is trending higher. Nearly a third (32%) paid all cash in February, the highest share in a decade. Baby Boomers accounted for the biggest share, with half of them paying all cash.

The share of distressed sales (foreclosures and short sales) continues to trend downward with only 2% of recent sales classified as distressed. That’s a sharp contrast from the 2008-2009 timeframe when nearly half the sales were foreclosures or short sales.

Lautz also discussed “generational warfare,” comparing activity by age segments. Gen-Zers (those in their late 20s/early 30s) have a high desire to become homeowners. NAR research shows the median age of today’s repeat buyer is 58, and they tend to have “lots of discretionary income.” Also active are multigenerational home buyers, accounting for 14% of purchasers during 2023.

Notably, senior buyers are different from what’s been reported in past surveys. Among the unique attributes NAR revealed are:

- Following the grandbaby

- Downsizing is out

- Seniors are buying new forever homes

- Roommates who co-purchase are common

- Smart home and green features are important

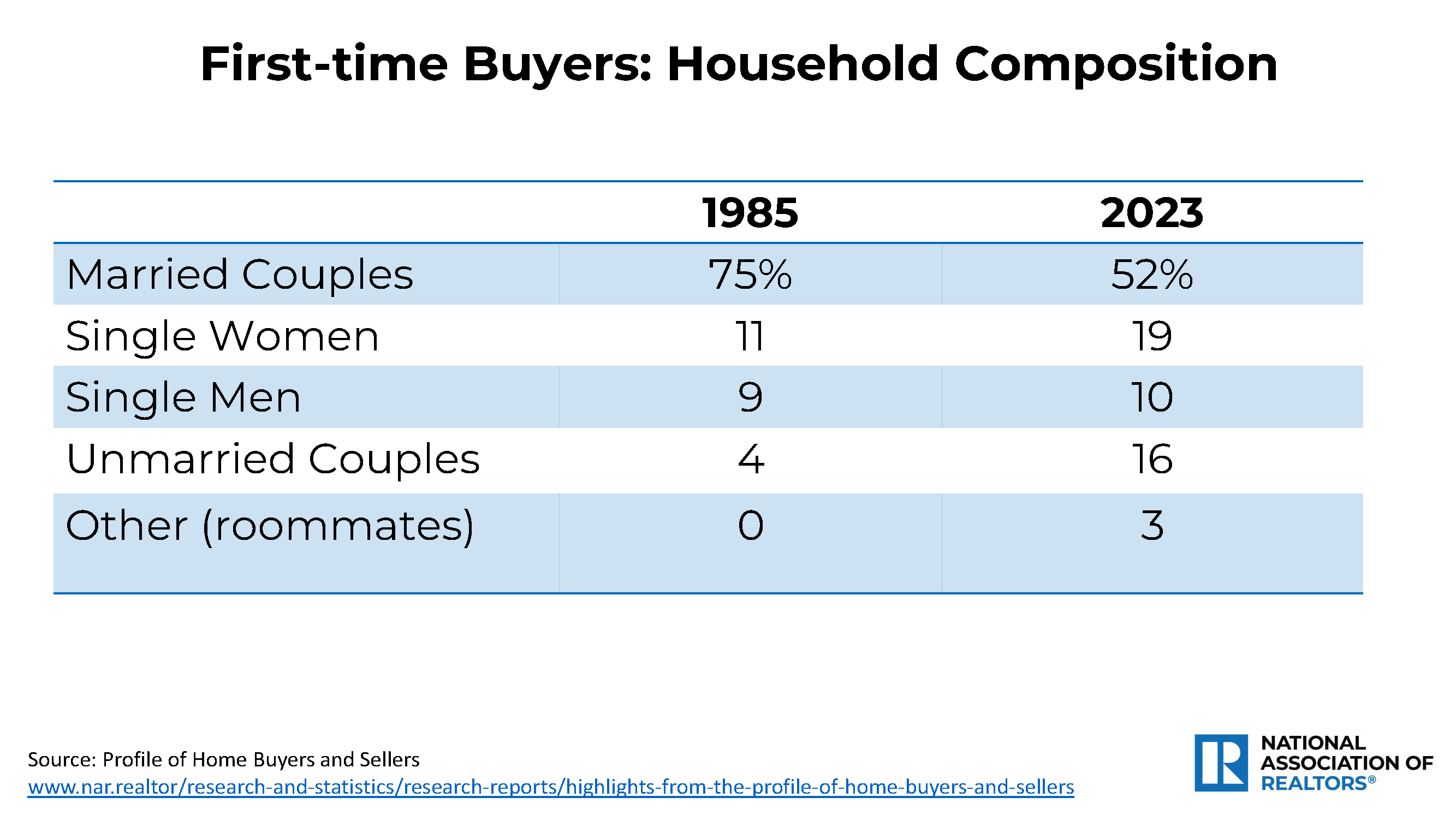

Another shift Lautz highlighted involved the household composition of first-time buyers. Whereas married couples accounted for 75% of first-timers in 1985, they made up only 52% of last year’s buyers.

Single women increased from 11% to 19% during the same time span, while the proportion of men was essentially unchanged (9% vs 10%). In 1985, four percent of first-time buyers were unmarried couples; last year, that number rose to 16%. Three percent of last year’s buyers purchased as roommates, which compares to none in 1985.

About half as many buyers in 2023 had children under age 18 (30%) when compared to 1985 (58%). This “baby bust” shift has significant implications, affecting the size of home and how it is used. Also, schools have moved down on the priority list.

Another noteworthy fact is the influence of pets. While 40% of U.S. households have at least one child, 70% have a pet. Fully 19% of buyers said they factor their pet into their choice of neighborhood. A similar number of REALTORS® (18%) said they had client who moved solely for their pets.

Lautz also discussed the implications of back to the office trends. A comparison of states shows top areas with net gains in 2022 tended to be in the South or Southwest, led by Florida, Texas, North Carolina, Arizona, and Georgia. Thirty-two of the 50 states had an inbound moving rate higher in 50% in 2022. Washington’s inbound share was 49.075%, higher than neighboring Oregon (44.87%) and California (36.785%)

California topped the list of states with the highest levels of negative net migration, followed by New York, Illinois, New Jersey, Maryland, and Massachusetts. Nine states (including the District of Columbia) had an outbound rate higher than 50%.

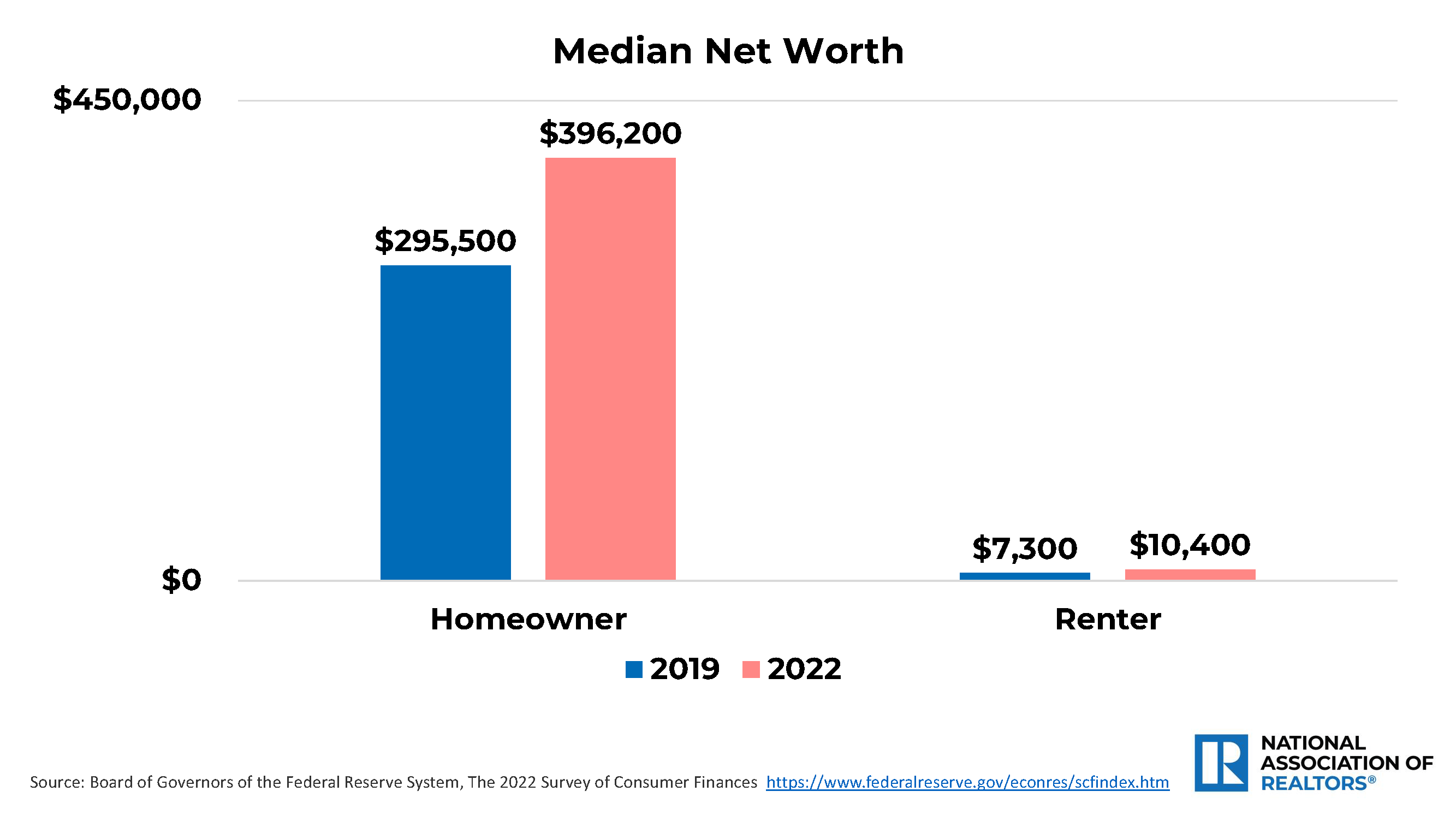

Among other statistics Lautz shared to demonstrate why real estate matters were a snapshot of race and home buying, buyer demographics by race, median net worth by race, and a comparison of median net worth among homeowners and renters in 2019 and 2022:

Following the presentation by the NAR economist, SKCR president Michael Orbino moderated a panel of industry experts on business strategies to succeed in the ever-evolving 2024 market. Orbino is co-founder and managing broker for Team Foster Builder + Developer Services

Panelists included:

- Jasen Neutzmann, CEO, Absolute Mortgage

- Robert Lipston executive vice president of production, Evergreen Home Loans

- Stephanie McCarthy, owner, Corcoran Lifestyle Properties

- Seyedeh "Yassi" Jazayeri, CEO & founder, Yassi & Associates, Keller Williams Luxury

- Rachel Mehmedagic, co-owner and designated broker, Windermere Real Estate Mercer Island (RARE Northwest)

During the discussion, Orbino asked panelists to rate the housing environment, mood among REALTORS® and Affiliates, affordability and layoff concerns, effects of technology, the return to office movement, and strategies around the new agency law.

Asked about the lending environment, Neutzman and Lipston said volatility and uncertainty about rates are challenging. “It’s important to work with the lender and not just take a ‘set it and forget it’ approach," Neutzman emphasized. From a credit score standpoint, debt ratio is the #1 consideration, but he encouraged Realtors to talk to lenders. “You may be able to get more people into houses than you think.”

Lipston believes “in adversity lies opportunity.” He said now is the time to make sure people understand the value and benefits of homeownership, and how REALTORS® and lenders can develop strategies to help people get into homes. Noting the average person is $6,000 in debt, he mentioned options to pay off such debts. “Let’s change the rudder and work together,” adding, “We have to be true debt advisors,” which takes more effort and energy.

Suggesting brokers are not as optimistic, Orbino asked REALTORS® on the panel to discuss “winning profiles.”

“Ask a busy person,” stated Mehmedagic, adding “People who have full calendars and interact with people every day are magnetic.

Jazayeri said agents who are proactive, attending classes and going to events are the ones who are selling, while winning buyers are those who are forward thinkers and who are educated about the market. “You need to help them adjust to the market promptly. You need to have more, higher level conversations so they understand the value of purchasing now,” she advised, noting they’re competing with investors – who made up about 70% of last year’s buyers.

McCarthy echoed remarks by other panelists. “Being involved in local associations and the community, going to Hill Day, and being able to talk about current changes can be powerful.”

Orbino asked panelists to discuss profiles of outperformers.

Neutzman said their most successful branches are outside the main urban areas. “There is demand everywhere. Where people are winning is with a wide array of loan options."

Lipston said they are having four-to-five touches to move people off the fence. He also shared that last year, their company held focus groups to better understand the biggest barriers borrowers face, and said that feedback helped them create products and market pieces. “We won by educating consumers they could overcome barriers. We trained our team on addressing consumer fears.”

Panelists were also asked to comment on the new agency law. While there was some initial adjustment, most said it is not an issue. “We viewed it as an opportunity to enhance transparency and build trust with clients,” said Jazayeri. “While not everyone loves it, we’ve been getting great results.”

McCarthy suggested the Pacific Northwest has been “ringleaders” in the move to enhance transparency. “Why are brokers nervous to talk about our killer value?”

When asked to identify the biggest threats to the industry and the opportunities that most excites them, panelists were eager to respond.

Neutzman said the biggest threat is disinformation and misinformation, and the lack of filters in the ways people consume media. “Our greatest opportunity is education. If we can’t educate consumers about the wealth creation opportunities of homeownership, then we’re not doing our job.”

Lipston reminded brokers people who were bumped out of the market in the past can buy today, but he stressed that “We have to use our voices everyday and partner together.”

Saying she doesn’t dwell on the negative stuff, McCarthy told the audience her head is spinning with strategies to get buyers into a house. “Maybe look at the dream a little differently, such as buying with someone else.”

Having a dynamic database is important, suggested Mehmedagic. “Now is the time to add to your database. Make new friends and contacts. Get out and let the sunshine in!”

The Women’s Council of REALTORS® Seattle Metro and South King County chapters collaborated on presenting the special event.